Burn, baby, burn

The numbers flying around AI are truly eye watering. McKinsey estimates $7 trillion will be invested in AI infrastructure before 2030. OpenAI on its own is projected to require more energy capacity than all of India in 8 years.

A contender for most outlandish claim is surely Sequoia’s Shaun Maguire for arguing that code generation could be a $10 trillion (with a t) market (or about 3x the entire GDP of the UK). 🤔

QED’s Frank Rotman has argued that the VC ecosystem has become velocitized, numb to increased pace such that normal speed feels slow. As one of our seed partners recently said on a call, VCs have “lost sight of what a $10bn valuation actually means.”

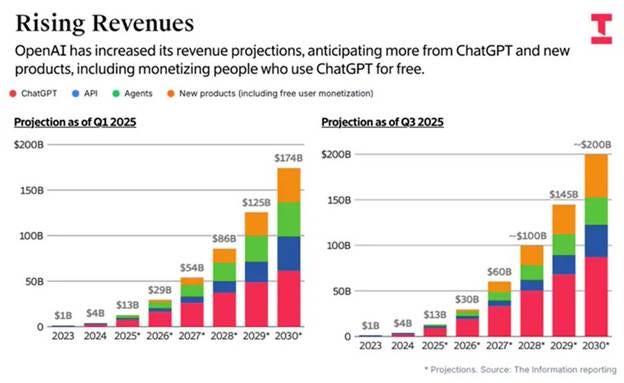

Within this ocean of gigantic numbers, The Information published the chart below earlier in the month to demonstrate OpenAI’s staggering revenue growth to $200bn revenue by 2030.

This was accompanied by an equally jaw dropping report of a projected cumulative cash burn of $115bn through 2029. We now know that NVIDIA is seeking to invest up to $100bn to cover the vast majority of this capital requirement (at least that’s what the headlines say).

Needless to say $115bn is a lot of capital to invest into a loss making entity. For context, this one company would consume 1.5x the $75bn raised each year by US VCs.

And yet. Each technology cycle requires capital commensurate with the size of the addressable market. Each cycle has a poster child of what appears to be profligate behavior at the time and looks to be visionary in retrospect: Amazon burned ~$2bn in the Web 1.0 cycle; Uber burned ~$35bn in the Web 2.0 cycle. OpenAI is now seeking general-purpose intelligence embedded across every industry.

If you believe AI has a total addressable market an order of magnitude larger than prior cycles, a triple-digit billion burn is not a sign of excess but is exactly in-line with expectations.

Not that there is much of a role for VC here. The AI infrastructure layer (including the power / energy layer) and the foundational model layer is a game of kings (literally in some cases), backed more by sovereigns and strategics than Sand Hill Road firms. Is raising 2/20 SPVs to YOLO into Anthropic’s latest round really what VCs should be doing?

These high capex layer needs to be in place in each cycle ahead of VC’s power law vintages. As we’ve written before, being early can be tantamount to being wrong.

Investing in AI is a consensus bet now. Jerry Neumann has gone further to argue that AI is not going to deliver stellar returns for investors (more akin to investing in shipping containers than software, with value accruing to incumbents and consumers rather than investors).

We don’t share this view. As Marc Andreessen has argued previously, there was not a Tech Bubble in 1995-2000, but a Telecom Bubble. Similarly, the huge capex investments into AI (maybe the “AI Infrastructure Bubble”), including OpenAI’s $115bn burn, will create all kinds of interesting unexpected opportunities for entrepreneurs and investors alike.

Capital has undoubtedly been misallocated in this AI Infrastructure Bubble, but just as internet adoption surged during and beyond the Telecom Bubble, AI adoption will continue apace. As such, VC’s power law vintages for AI are likely still ahead of us.