Series B theme: a quiet FinTech revival

AI, defense and crypto rounds are dominating the headlines. But, beneath the noise, FinTech is quietly staging a comeback at the Series B stage.

After two years of retrenchment, Series B activity in FinTech is rebounding. Crunchbase reports $22bn invested in FinTech in H1 2025 (across all rounds), representing 5% growth relative to H1 2024.

This momentum has been supported by recent successful FinTech IPOs, including Circle & Chime. Wealthfront, Gemini and Navan are also slated to IPO later this year.

The growth-at-all-costs mentality that characterized the previous FinTech investment cycle has been replaced by a more measured approach. The focus is on B2B payments, institutional-grade B2B infrastructure & (of course) AI-native FinTech.

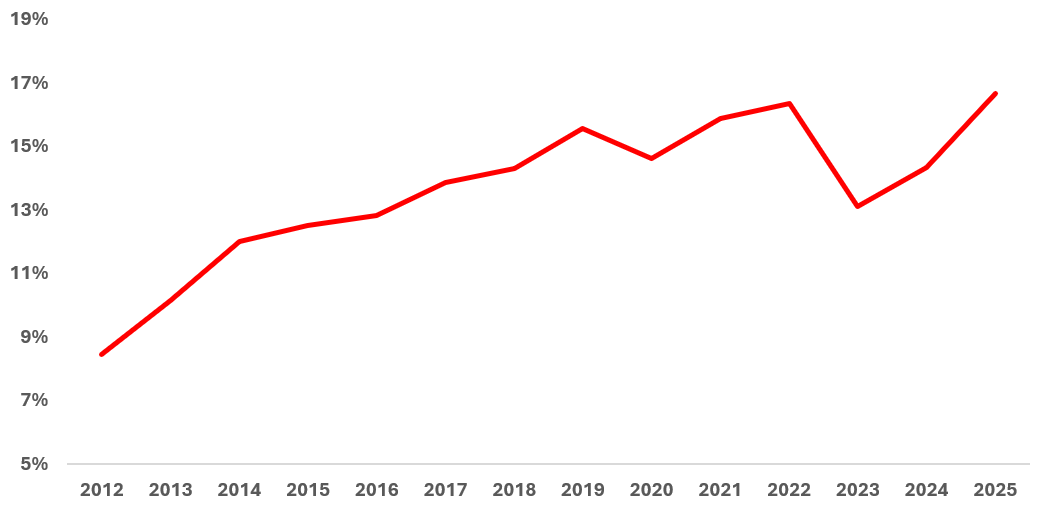

As a share of all Series Bs, FinTech has climbed back to 16%, continuing its long-term upward trajectory (Figure 1).

Figure 1. Number of FinTech Series Bs as a % of all Series Bs

Source: Crunchbase

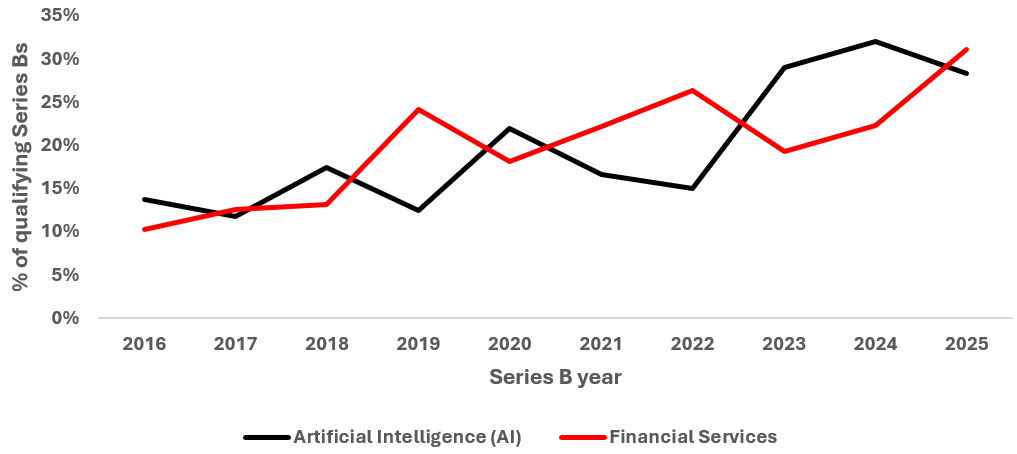

SignalRank’s algorithms seek to identify the top 5% of all Series Bs. FinTechs now represent almost one third of all qualifying Series Bs on SignalRank’s approach. In fact, as Figure 2 shows, more FinTechs have qualified for our product this year than AI companies.

Figure 2. FinTech & AI companies as % of all Series B SignalRank qualifiers

Source: Crunchbase & SignalRank

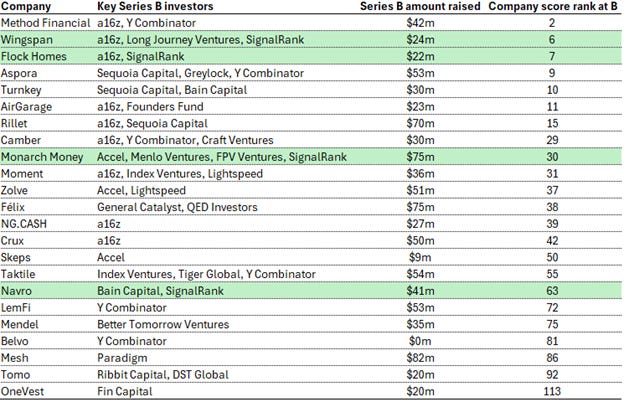

There have been 23 FinTech qualifiers in 2025 YTD (Figure 3). SignalRank is an investor in four of these 23 (highlighted in green).

Figure 3. All FinTech qualifiers with 2025 Series Bs

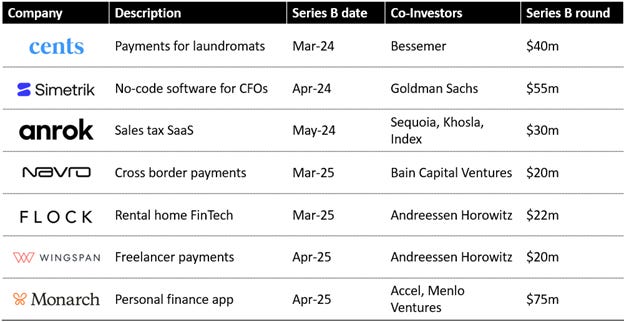

Of SignalRank’s 36 portfolio companies, 7 are FinTech companies (Figure 4). Or 19% (which is slightly underweight relative to the whole qualifying set).

Figure 4. FinTechs within SignalRank’s portfolio

So what?

AI continues to absorb much of the VC world’s attention & capital. But other non-AI sectors have adapted to the new post ZIRP environment and are beginning to attract capital again with much more operational discipline & more capital efficient models.

The systematic nature of SignalRank’s approach enables our investment product to capture these shifts, giving our investors exposure to the FinTech revival.