Talent networks: the new credentials

Talent is everywhere but opportunity is not.

Over the last two decades, Silicon Valley has developed new models of credentialing to channel opportunity to exceptional founders. Programs outside of traditional educational institutions, such as Y Combinator, the Thiel Fellowship, Entrepreneurs First and Nat Friedman’s AI Grant, credential entrepreneurial potential. In doing so, they have become powerful filters for talent.

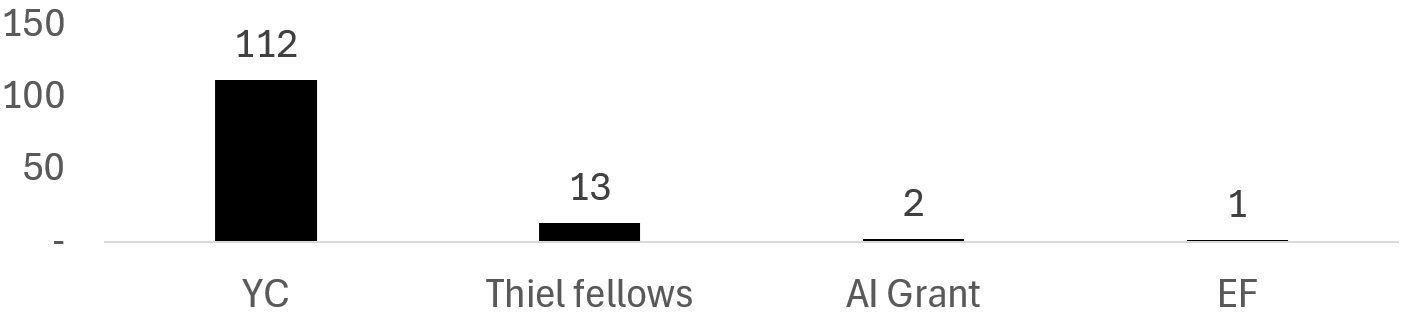

Y Combinator, founded in 2005, has backed 112 unicorns to date, including Reddit, AirBnb, Coinbase, Dropbox & Doordash. Other programs started later and are having early success in channeling resources to potential power law companies (Figure 1).

Figure 1. Unicorns per program (on Crunchbase data)

In this post, we use SignalRank’s model to examine the success of these decentralized / unaffiliated networks in identifying the next generation of successful entrepreneurs.

This post will focus on’ “upstream” early talent; a subsequent post will consider “downstream” talent for people who have worked at iconic companies that created entrepreneurial so-called ‘mafia. and go on to become entrepreneurs themselves.

Some context

The transfer of power from centralized institutions to decentralized networks is one of the core themes of our age. Trust in centralized institutions across all walks of life has never been lower, from media, politics, education and beyond.

The internet is the handmaiden to this change. We should expect higher variance outcomes in almost every sphere of human activity.

Matt Clifford, founder of Entrepreneurs First, offered an instructive framework for understanding this shift:

Variance-amplifying institutions (VAIs) are triumphing over variance-dampening institutions (VDIs). These institutions differ in what behaviours they promote and what characteristics they select for. VDIs select for norm adherence, predictability and consistency. They create negative feedback loops; bureaucracy is the canonical example. VAIs select for extremeness, surprise and virality. They create positive feedback loops; the internet is the canonical example.

One way to think about the triumph of modernity is as the gradual reduction in variance across most aspects of our lives. From the Peace of Westphalia to the welfare state, we’ve gradually built institutions that make life more predictable and narrow the range of outcomes to which we’re exposed (with some catastrophic failures along the way, of course). That era is coming to an end.

The internet changes this framing, as the ultimate variance-amplifying institution. It is permissionless, uncapped and promotes network effects. On the internet, anyone can do anything and, in theory, can reach any scale.

In this variance-amplified world, the relative signaling power of traditional credentials is lower. In turn, the relative value of entrepreneurship which can enable power law outcomes is perceived to be higher.

Universities confer predictable competence. A GPA score is legible across a cohort but less useful in terms of gauging entrepreneurship.

Kyla Scanlon just wrote a fascinating article here about the decline of university towns, arguing “America is facing its next Rust Belt moment - but it’s not our steel mills shutting down, it’s our education mills.” College enrollment is forecast to decline another 15% between 2025 and 2029 (where Scanlon argues this is in part demographics, in part lower trust in the value of college education).

The new economy prizes qualities of originality and boldness, neither of which are not captured by centralized credentials.

The new gatekeepers

Into this vacuum have stepped a series of new networks that validate potential:

Y Combinator (YC) - institutionalized the founder network with quarterly “graduations”

Thiel Fellowship – Peter Thiel’s team seeks out pre-college iconoclasts who can produce outsized outcomes

Entrepreneurs First – a riff on Teach First (UK equivalent of Teach For America) that has formalized “founder matching” and pre-company incubation

AI Grant – Nat Friedman’s micro grants to AI talent. It is unclear whether this will continue now he has joined Meta.

Each of these models is about early identification of exceptional people, providing them with small amounts of catalytic capital and community. They are the new on-ramp for elite entrepreneurship.

So how are they doing?

We analyzed companies that have gone through each program and subsequently raised seed rounds.

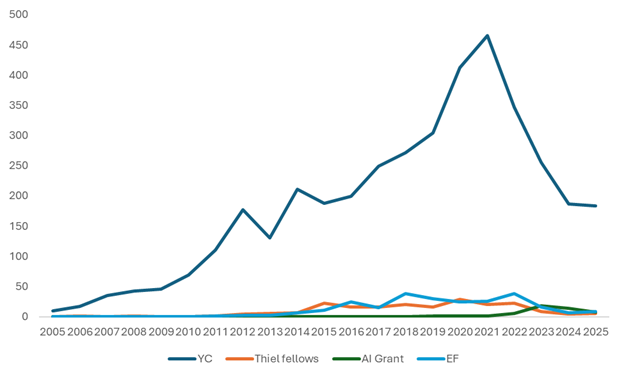

Figure 2 shows the number of seed rounds raised by program participants per year since 2005. YC is very active, with its graduates seeing 200+ seed rounds per annum even in the post-ZIRP era.

Figure 2. Seed rounds per year from companies backed by each program, 2005 onwards

We showed at the top the number of unicorns created per program (Figure 1). YC is leading the charge on absolute terms with 112 unicorns per Crunchbase data. The AI Grant program has backed Perplexity & Anysphere (Cursor), while Thiel fellows include the founders at Figma, Mercor, Loom, & Clay. EF’s sole unicorn is Tractable.

Given their success in identifying unicorns, it is perhaps not surprising that a number of funds have emerged to invest specifically in the best companies from the cohorts of each respective program, including Rebel Fund (YC focus), AVCF (YC), Pioneer (YC), Cathexis (YC), 1517 (Thiel fellows) and Browder Capital (Thiel fellows).

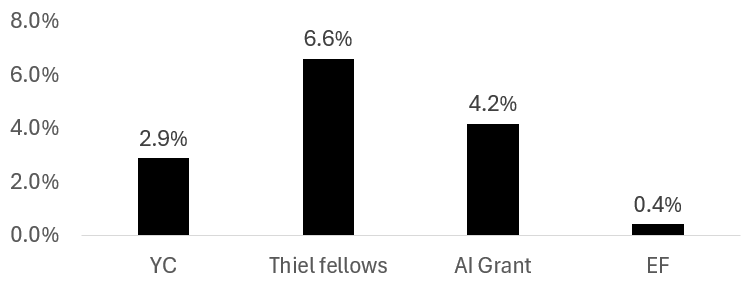

YC’s high diversification strategy generates high number of unicorns but it also impacts its unicorn efficiency, defined as unicorns divided by number of seed rounds. On this measure, the Thiel fellowship has a higher concentration of unicorn generation at almost 7% (including 2025 seed rounds which have not yet matured). As a benchmark, ~2% of all seed rounds globally go on to become unicorns.

Figure 3. Unicorn efficiency per program

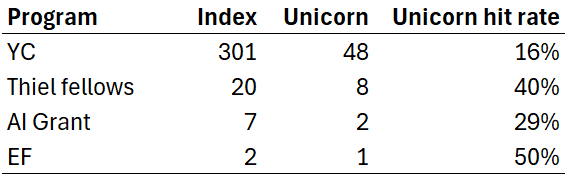

When we narrow the focus to Series Bs which would have qualified for SignalRank’s product, we see a similar pattern. 301 YC companies qualified for our product, with 48 going on to become unicorns, implying a 16% hit rate. That’s half of our backtest market average, suggesting that we should apply a harsher threshold to YC companies.

Figure 4. SignalRank Index historic qualifiers per program (2012-25)

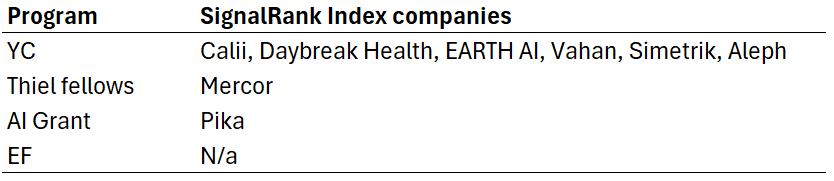

Given the 16% hit rate stat, our portfolio to date is probably overweight YC exposure. We have backed 6 YC companies, and only one Thiel company and one AI Grant company.

Figure 5. Portfolio companies in the SignalRank Index

Therefore, what?

Each of these programs is perceived as acting as a credentialing layer in the new startup ecosystem. We show here the signaling power of these programs, especially the Thiel fellows & AI Grant recipients.

However, it is worth noting that the number of companies “credentialized” by these programs is very, very small. Not many founders raise venture capital at all, and even fewer go through these programs. These programs are most useful for first-time founders, for whom brand recognition and access to rocket fuel VC dollars is relevant. In short, these programs are powerful but narrow measures of credentialing entrepreneurs.

You might even go further to argue that these networks are transitional forms of credentials. The next evolution may not look like a fellowship or accelerator at all, with AI systems instead relying on algorithmic public signals to continuously credential and connect talent in real time. In any event, the evolution of talent credentials is accelerating away from centralized institutions.