The venture majors

The largest VC firms are expanding beyond the traditional definition of venture capital.

This is unexpectedly leading to an improvement in SignalRank’s access to high quality Series Bs.

Contrary to concerns of crowding out, the venture majors’ larger round sizes and increased syndicate size actually creates more entry points for our model.

The venture majors

Sapphire’s Beezer Clarkson recently wrote this post about the state of seed & Series A, questioning whether “venture is broken”.

She looked at trends within mega-funds at the early stage, showing that the most active seed investors in the Bay Area & NY are now the mega-funds (Figure 1.)

Figure 1. The most active seed investors in the Bay Area & NY since 2022

The top four funds on the table above, specifically a16z, Sequoia Capital, General Catalyst and Lightspeed, are arguably now in a class of their own.

Each started as an early stage VC (as opposed to say other scaled venture investors, such as Insight, SoftBank or Thrive) and has made recent structural changes to enable accelerated asset accumulation with significant success:

a16z has been an RIA since 2019; closed $7.2bn suite of funds in 2024

Sequoia has moved to an evergreen structure whose AUM has hit $20bn

General Catalyst is rumored to be considering an IPO; closed $8bn new funds in 2024

Lightspeed recently registered an RIA; closed $7.1bn in 2022 and rumored to be raising $7bn in additional capital

This analysis by Abraham Thomas about the creation of these “venture majors” resonates; quoted in full here:

“Market-making is simultaneously more lucrative, less risky, and more scaleable than price-taking. As a result, the handful of firms that succeed in capturing market-maker network effects quickly achieve escape velocity. This has led to a new class of player in the industry: the venture majors.

These firms are vertically integrated — they play at every stage, from pre-seed to Series Z. They are horizontally expansive — they play in every sector, from software to robotics to biotech to defence to crypto. And increasingly, they play across geographies, and up and down the capital structure stack. No tech financing event is out of scope for them.

At the same time, they’re not really hunting alpha. Outperformance is not the point; rather, because of their increasing economies of scale, they just want to be part of every (material) deal. The result is, essentially, beta on the private tech market — it may not be a true ‘index’, but it offers highly-correlated directional exposure to the market as a whole, which is almost the same thing.

LPs love this. Most institutional investors want sector exposure first, and in-sector outperformance second. The venture majors provide precisely this.”

This analysis speaks most clearly about the four funds above, which we will collectively call the venture majors in the rest of this post.

Analyzing the venture majors

Clarkson’s analysis above focused on 90 mega-funds. If we just look at the four venture majors, are there any other recent trends we can observe? What is the impact on SignalRank (if any)?

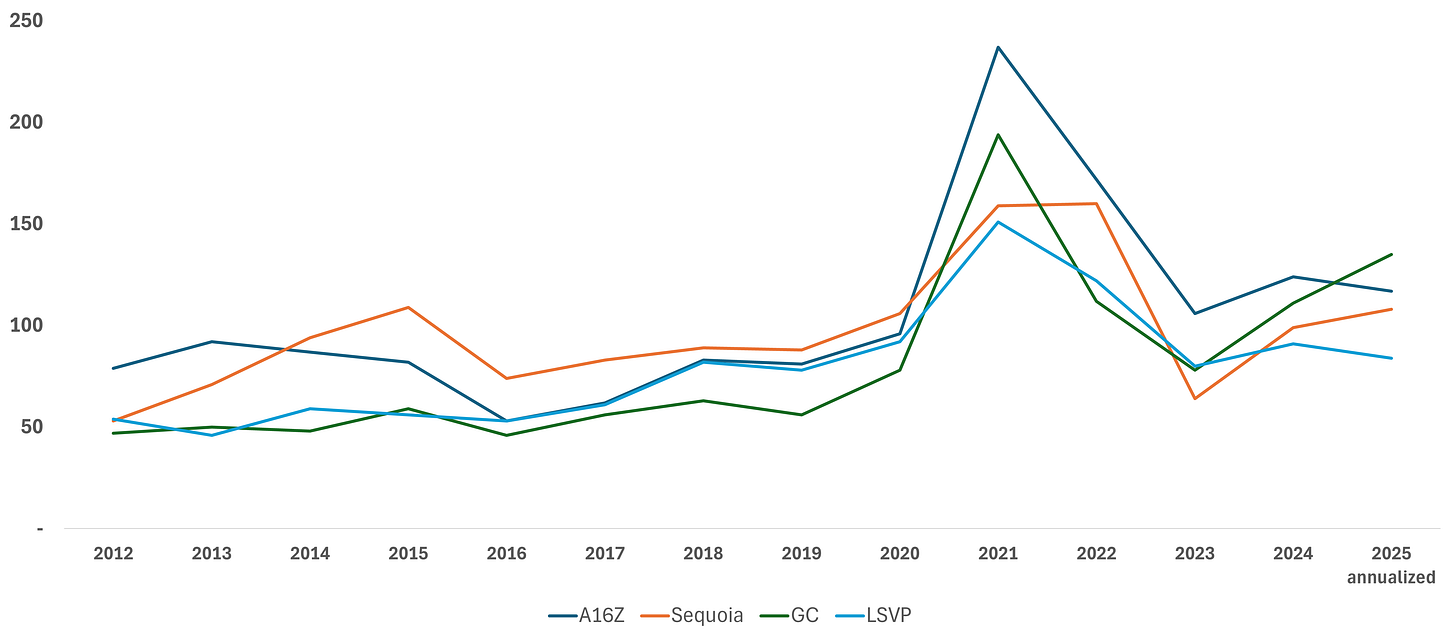

1. All investment rounds

The number of announced investment rounds by the venture majors each year has not increased commensurate with their increase in AUM. Each of the venture majors is still only making ~100 announced rounds per year.

The biggest changes have been greater seed activity and larger round sizes at every stage.

Figure 2. All announced rounds by the venture majors (pre-seed → Series F), 2012-2025

Source: Crunchbase

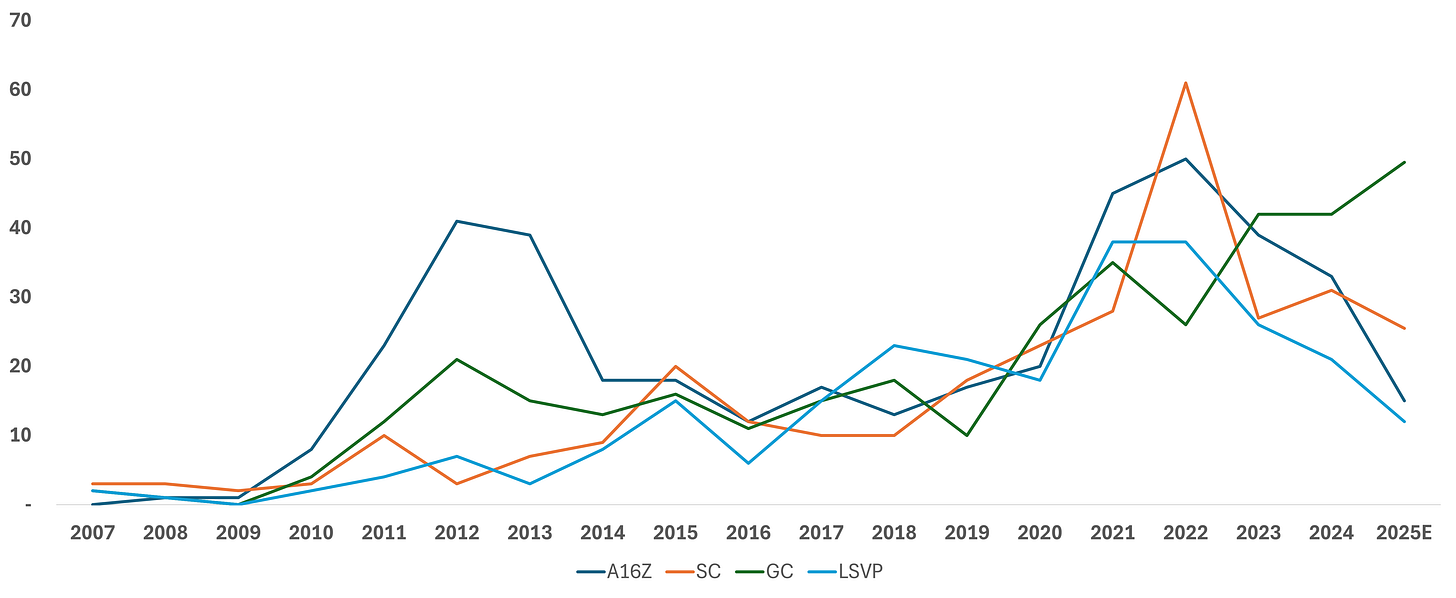

2. Increased seed activity

The number of seed investments has increased markedly over the last 15+ years for the venture majors. At current pacing, GC is on track to make 50 announced seed rounds in 2025 (interestingly in an opposite direction to the other three whose seed activity has decreased in 2025 relative to prior years).

Figure 3. # of seed investments per year by venture major, 2012-2025 annualized

Source: Crunchbase

3. Larger seed rounds

A significant change has been the size of seed rounds. The maximum seed round participated in by any of the venture majors in 2010 was $2m. The lowest maximum of any seed round by a venture major was $25m in 2025 (see Figure 4).

Figure 4. Maximum seed round size by venture major, 2022 onwards

Source: Crunchbase

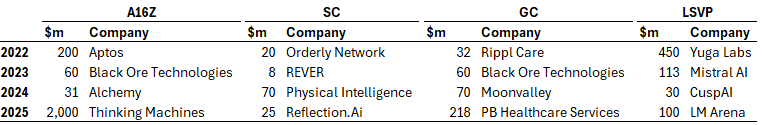

4. Admirable seed conversion to Series A

12% of all global seed investments since 2022 (from January 2022 to today) have raised a Series A. This increases to 21% for the top 100 seed investors on SignalRank’s model.

The venture majors’ seed conversion is higher still, roughly in-line with the top 20 seed investors on our model (Figure 5). With significant capital behind each of them, this is perhaps not so surprising.

Figure 5. Venture majors’ seed conversion for 2022+ seed investments to Series A (compared to top 20 seed investors and top seed investor on SignalRank’s model)

Source: Crunchbase; SignalRank

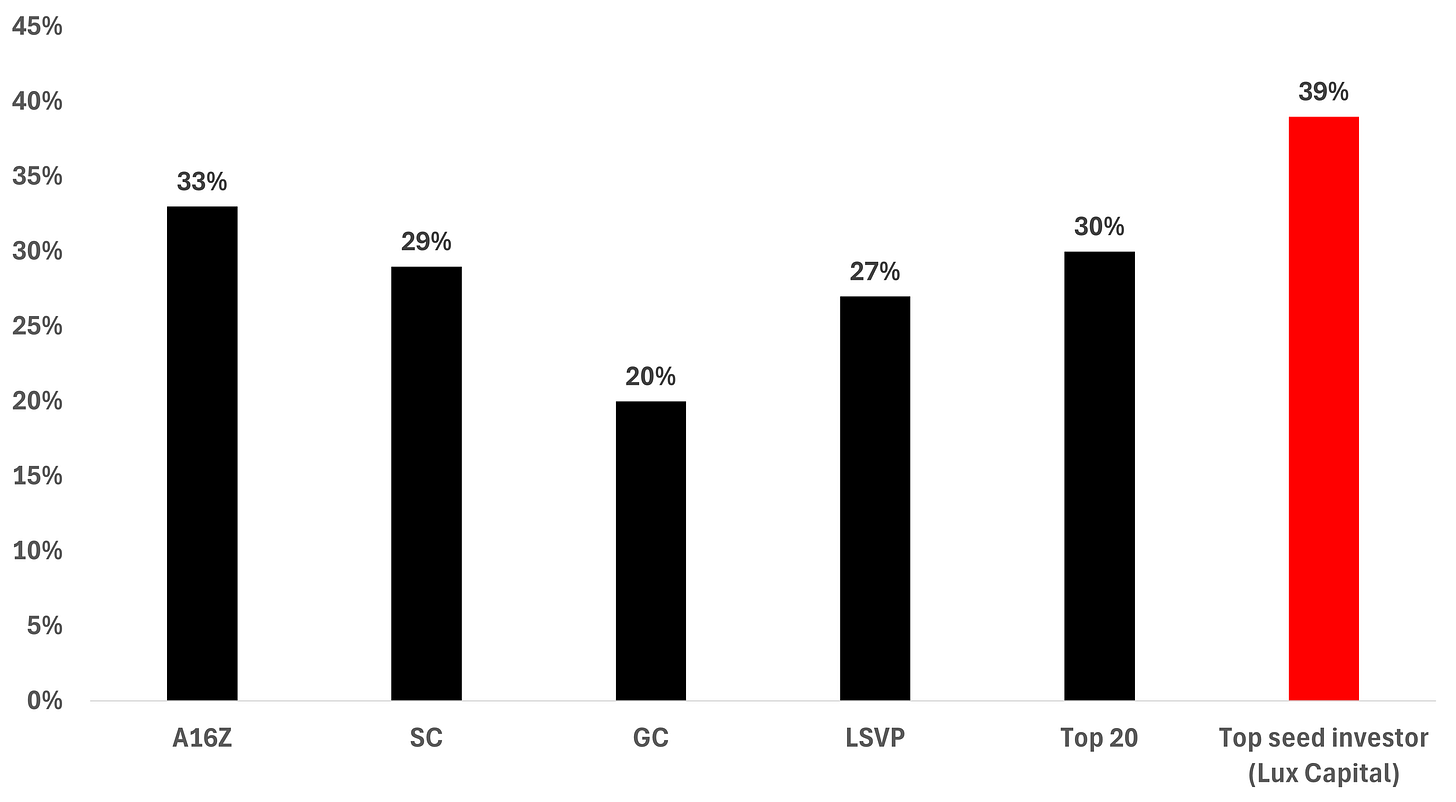

5. Stable Series B dynamics

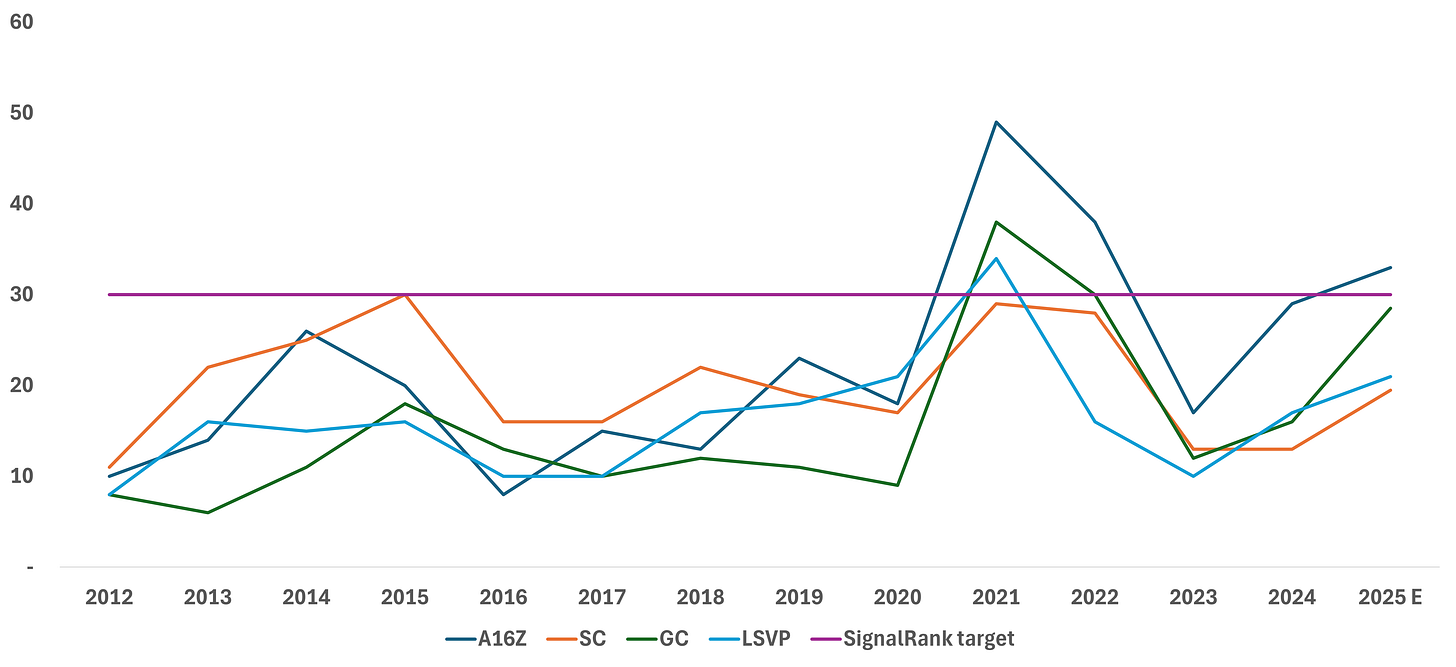

The number of Series Bs that the venture majors have invested in increased but not in-line with asset accumulation. And the unicorn hit-rate has not improved over time.

SignalRank’s target number of investments is also superimposed here to demonstrate how making 30 investments per year provides SignalRank with significantly higher diversification than any one venture major.

Figure 6. # of Series B investments by venture majors, 2012 to 2025 annualized

Source: Crunchbase

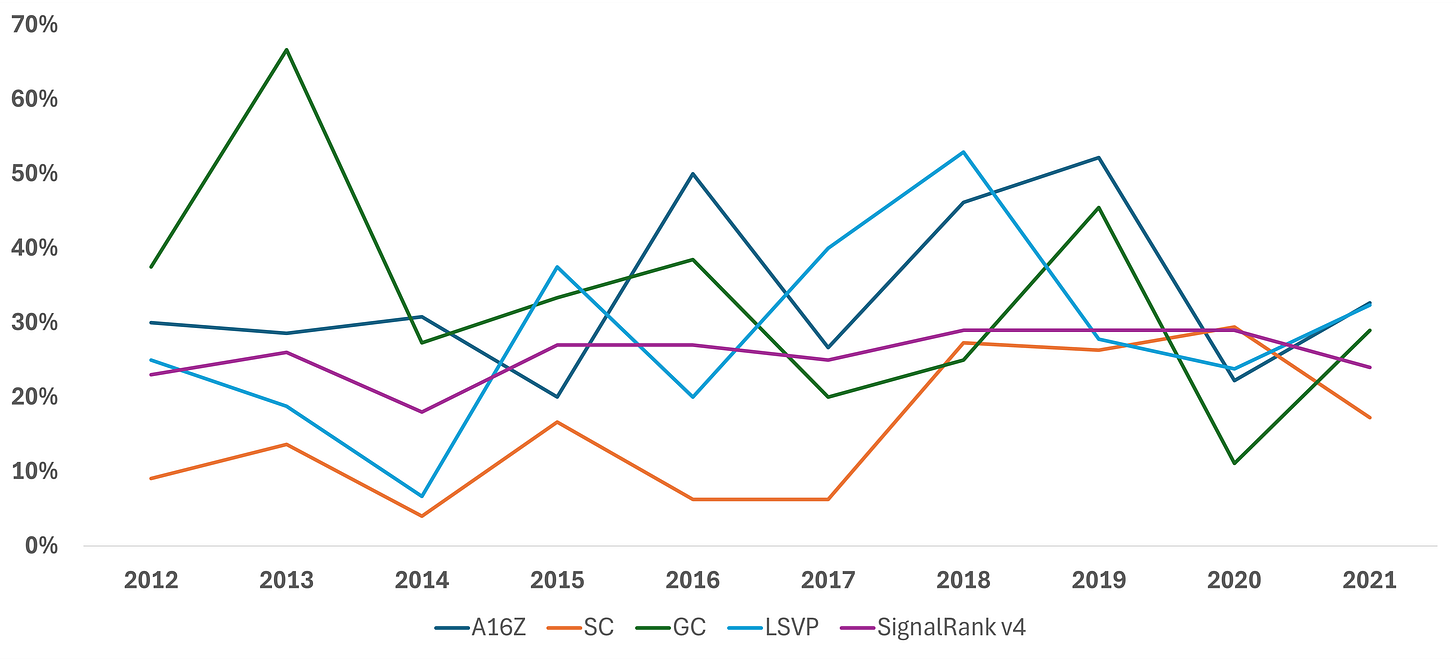

Again, SignalRank’s backtest unicorn hit rate is superimposed here to show the consistency of a high diversification strategy. Data to 2021 to provide Series Bs with 3+ years to achieve unicorn status.

Figure 7. Series B unicorn hit rate for venture majors, 2012 to 2021

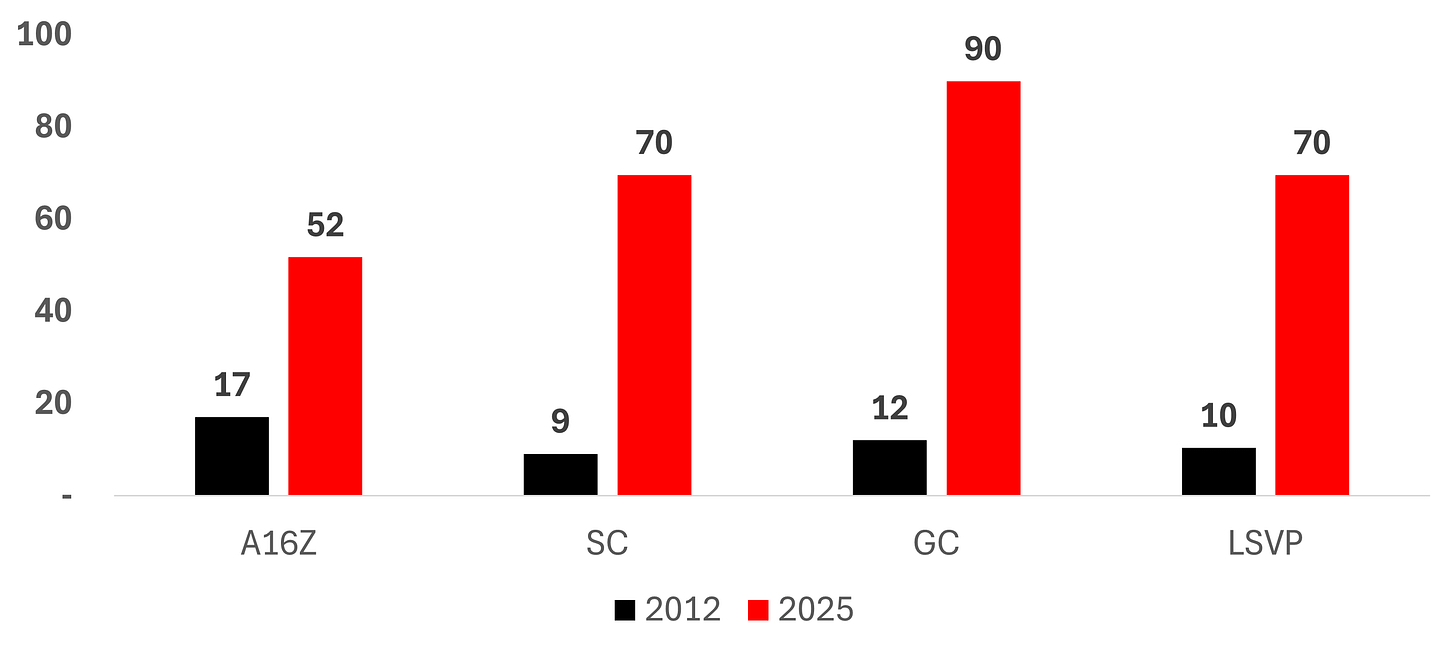

6. Expansion in Series B round sizes

The biggest change at Series B has been the round size expansion. Average Series B round sizes by the venture majors has increased by ~7x since 2012 (Figure 8). This compares to ~5x for all Series Bs over the same timeframe ($12m in 2012 to $54m in 2025).

Figure 8. Average Series B round size for venture majors (2012 vs 2025, $m)

7. Why this matters to SignalRank

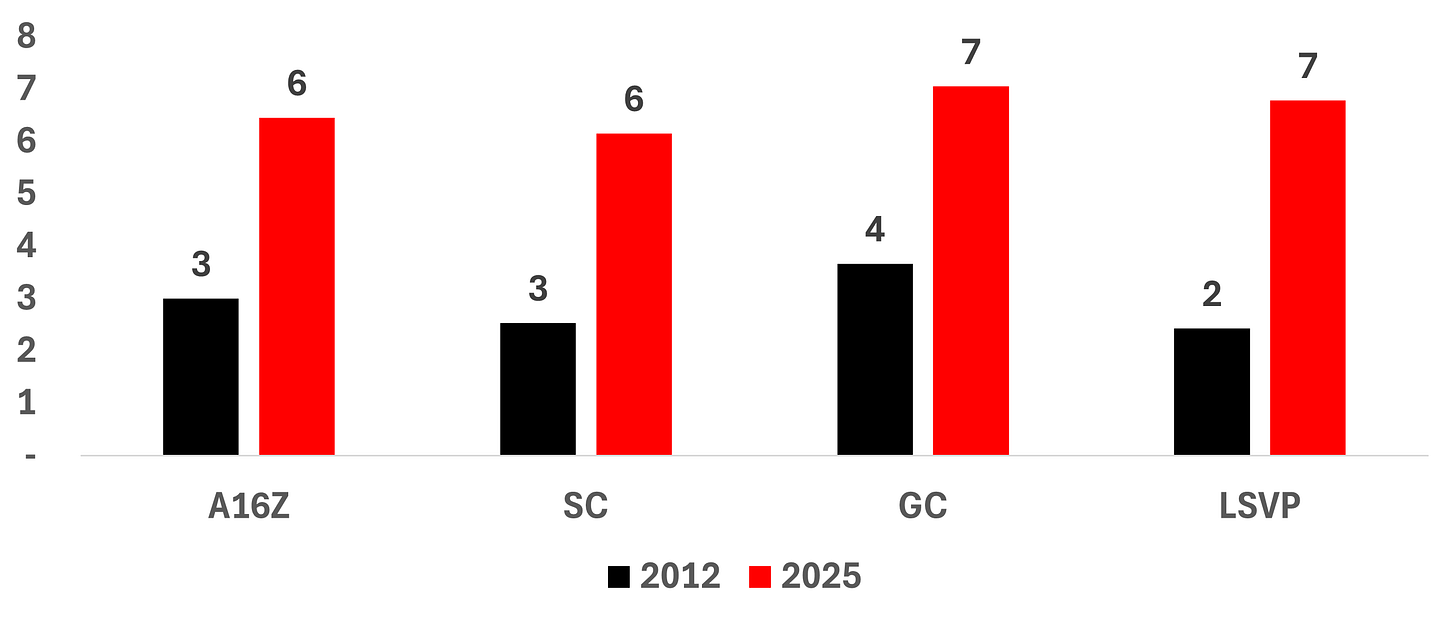

This increase in round size has led to a doubling in the average number of investors in a venture major Series B round (Figure 9).

Figure 9. Average # of investors in venture major Series B rounds (2012 vs 2025)

This round participant count is important for SignalRank. It demonstrates that the number of potential access points for our pro rata strategy has increased over time.

The received wisdom that a “Tier 1 lead” will squeeze out other investors in quality Series Bs does not bear out when analyzing the data.

Concluding thoughts

The stratification of the venture ecosystem continues apace. The four venture majors represent a differentiated type of diversified asset manager relative to even other “mega-funds.”

For SignalRank, the implications are clear. Larger Series B rounds and more syndicate participants mean our pro rata model is strengthened, not weakened.