What is venture capital’s core product? Can it scale?

For an industry focused on disruption, there is remarkably little innovation within venture capital itself. Arthur Rock, the OG VC behind Fairchild, Intel & Apple, could don a Patagonia gilet and feel comfortable within most investment committees today.

The product offered by VCs has not changed. Floodgate’s Mike Maples observed that a VC’s product at its core is its decision-making engine. There is ordinarily no such thing as proprietary deal flow and many investors add minimal value. The uniqueness of a partnership comes down to the strength, culture, and dynamism of a firm’s decision-making process. LPs are buying a firm’s process; the results should take care of themselves.

When viewed through this prism, VC cannot scale. It remains an apprenticeship-based artisanal craft, not a commodifiable & industrialized data-driven product. In fact, adding additional humans to an investment committee is likely to make for worse decisions, not better.

VCs have liked to integrate sourcing, capital & value-add services to this core decision-making process. It’s the whole product, packaged as one for LPs. But the history of technology, at least as told by Clay Christensen, is that modularity beats integration every time: “the transition from proprietary architecture to open modular architecture just happens over and over again.”

What if you applied this logic to venture capital? What if you outsourced decision-making? What if you separated decision-making from sourcing, capital & value add services? What if technology was applied to the venture capital industry itself?

Jim Barksdale, the former CEO of Netscape, is credited with saying, “there's only two ways I know of to make money in business: bundling and unbundling”. In this post, we are going to use the framework of unbundling/rebundling to consider how venture capital could be rebuilt for scale.

The unbundlers

There is an infamous conversation between Marc Andreessen & Jim Barksdale with Harvard Business School here to consider how distribution technologies enable bundling & rebundling. They discuss how the internet frees distribution from the constraints of “time and place.”

The proliferation of digitally-distributed data is finally started to lead to the unbundling of venture capital, freeing it from similar constraints of time and place.

We are going to consider three different models of unbundling VC: solo GPs, guilds & AI models.

Solo GPs

LPs have historically backed partnerships of multiple GPs, where diversity of opinion, complementary skillsets and access to differentiated networks should improve outcomes. Not to mention the ability to diligence more opportunities by adding additional bodies.

Yet the relative importance of an individual’s brand within a partnership has been increasing for a while. Correlation Ventures argued in 2017 that the value of a firm is no more than the sum of its partners. Founders are keen to work with specific individuals (who are ideally ex operators, not Excel jockeys), instead of specific firms. This has happened simultaneously to the professionalization of angel investing. And of course the growth of social media. Contrary’s Kyle Harrison has an admirable series on the current unbundling of venture capital where he focuses on the rise of solo GPs.

Footwork’s Nikhil Basu Trivedi first pointed out the rise of solo capitalists in 2020. The collapse of the industrial unicorn complex since 2022 has acted as a catalyst to this trend. High profile GPs in their 30s and 40s are increasingly electing to spin out on their own rather than spend the next ten years delivering 1.0x DPI for the 2020/21 funds.

Pitchbook wrote a recent article on the growing phenomenon of solos GPs and listed notable recent funds (including Elad Gil who has raised a $1bn solo fund and is rumored to be in market for a new $1.5bn fund):

Figure 6. Notable recent solo GP funds

Solo GPs are undoubtedly unbundling themselves from the traditional VC product. An individual investor cannot of course scale. Yet the development of a network of solo GPs could enable a more diverse and broader set of investment products which in aggregate could scale better into niche areas than the traditional product allows for. Individuals can take their interests where they want.

Guilds

Syndicates enable individual investors to make stand-alone investment decisions on individual opportunities, thereby unbundling capital and decision-making from the core VC model.

Investment syndicates are nothing new. The Band of Angels, created in the 1990s by a group of ex HP & Sun engineers, is credited with being the first high technology specific angel investment group in the United States. Digitally-enabled models like AngelList syndicates (including former employer angel groups, such as AirAngels from AirBnb) are the inheritors of this model.

There is a current growth in digitally-enabled communities focused on specific verticals, similar to guilds of yore. These are groups based on the loose bond of former employee affinity but based on vertical expertise. This allows these communities to diligence tools they would use in their profession and to be more hands-on with products. Examples include FOG Ventures (based around the Operators Guild, largely focused on CFOs) or PeopleTech Partners (based around Chief People Officers).

The challenge with these groups is that they typically represent smaller pools of capital. They also tend to be reliant on a few core nodes in the network who do most of the heavy lifting (sourcing, memos, managing deals, etc).

AI models

We have discussed before how data-driven VC is becoming more normalized. It is possible for a machine / AI agent to screen/scrape/source opportunities at a scale that is not possible for an individual human. There are multiple services that will unbundle the top of the funnel for VC sourcing. See Andre Retterath’s site for examples of such services.

SignalRank itself leverages industry-level data to offer an unbundled product in three respects:

The most disruptive (and controversial) element is the unbundling of investment decisions. Our quantitative approach outsources decision-making to the best investors in the world – we only invest into companies where the best decision-making engines in the world have supported a company across three separate rounds. We exclusively follow rounds. There is a curious tension that we can scale our own product (our decision-making engine) by leveraging the excellence of less scalable third party decision-making engines.

We unbundle power law companies from the entire fund. We do not need to become an LP to access the break out companies. To reference an example in the Andreessen/Barksdale piece, you don’t have to buy the whole CD to get one track. We are offering a data-driven Spotify playlist.

We are intellectually honest with our partners. We solely bring capital as passive investors. Vanguard does not proclaim to offer value add to the S&P 500 companies. Neither do we. Nevertheless, in the same way that the S&P 500 has become a well established brand of quality, so we hope that in time being described as a “SignalRank Index” company will become a badge of honor.

The rebundlers

Rebundling often happens when new distribution technologies or paradigms enable a superior integrated offering.

A harder question to answer is what a rebundled tech-enabled VC would look like. Here are we are going to focus on product-led rebundling & network-led rebundling.

Product-led

Back in the day, A16Z redesigned the game with their platform model. They package modular value-add services delivered by their army of functional experts into comprehensive offerings. But it is challenging to argue that the core of this approach is powered by a new distribution technology. And the product (decision-making engine) remains largely unaffected by tech.

It is likely that AI agents will be at the center of any new form of rebundled VC. We know of various groups who are building AI agents that have been trained on all the available VC literature, so a founder can have a conversation with a Paul Graham / Vinod Khosla / Mary Meeker chatbot about how to approach whatever problem they are seeking to solve.

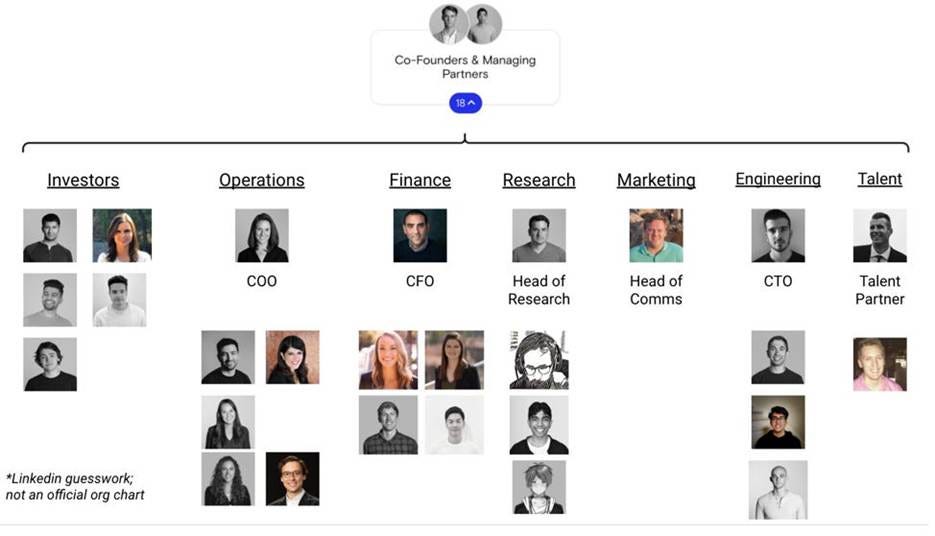

An alternative vector of growth is to build a venture capital firm like a product-led technology start-up. Kyle Harrison cites Paradigm as a good example. “What would a venture fund look like with a CEO, CTO, a Chief Product Officer? A Head of Sales?" (Figure 2)

Figure 2 Paradigm’s org structure

Network enabled rebundling

Mario Gabriele, who runs The Generalist, recently wrote a fun piece about “Mullet Capitalists.” These are groups which have built tech-enabled communities where one form of monetization is via venture capital. He references groups which offer “recruiting firm in the front, venture in the back.” Bain Capital was the pre-digital OG of this strategy as a spin out from the Bain consultancy. The new mullet capitalists are digitally enabled.

Acquired, Not Boring, 20VC are all media groups that command online communities of tech founders, operators and investors. Similarly, Superconnector is an outsourced SDR network which can supercharge portfolio support. These networks generate their own organic (and unbundled) sourcing. Capital is then stapled on.

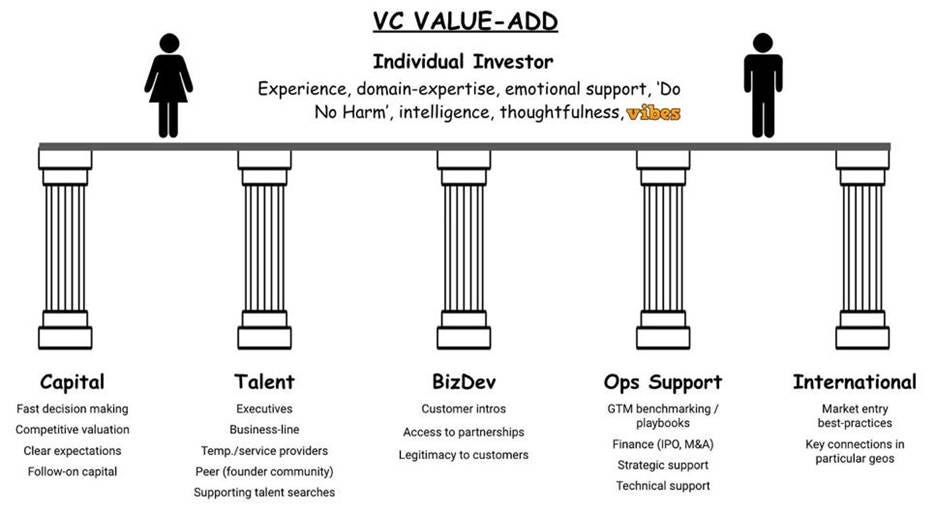

You can imagine how this rebundled approach could be applied to VC value-add writ large. Could there be an rebundled value-add VC for each column in Kyle Harrison’s diagram below (Figure 1)?

Figure 1. Kyle Harrison’s framework for VC value-add

Concluding thoughts

It can be tempting to overstate the case either for stasis and for rapid innovation within the venture ecosystem. The truth is somewhere inbetween.

The reality is that the megafunds are scaling AUM at quite a clip without huge changes to the core business model. They are absorbing ever higher proportions of capital. And delivering returns at scale (see Figma).

Yet GC claims to have outgrown venture capital. They are branching into buyouts and private credit. And these funds are still small by comparison to PE.

For further growth to continue (and for challengers to make a dent in this ecosystem), we expect to see some of the models outlined above achieving escape velocity.

As Sequoia’s Doug Leone said, the only constant in VC is change.